Annual income after taxes calculator

Determine your annual salary. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Your average tax rate is.

. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. If your salary is 40000 then after tax and national insurance you will be left with 30879. Your employer withholds a 62 Social Security tax and a.

Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Australian income tax calculator Your income.

With five working days in a week this means that you are working 40 hours per week. Enter your info to see your take home pay. All other pay frequency inputs are assumed to be holidays and vacation.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. How to calculate annual income.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This places US on the 4th place out of 72 countries in the. For example if an employee earns 1500.

Then multiply it by 52. Try out the take-home calculator choose the 202223 tax year and see how it affects. This means that after tax you will take home 2573 every month or 594 per week.

Over the last few years withholding calculations and the Form W-4 went through a number of adjustments. How Income Taxes Are Calculated. After salary sacrifice.

The amount of federal income taxes withheld will depend on your income level and the withholding. Your average tax rate is. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076. That means that your net pay will be 37957 per year or 3163 per month. Youll agree to either an hourly wage.

Annual Income 15hour x 40 hoursweek x. See How Easy It Is. On the new W-4 you can no longer claim allowances as it instead features a five.

Depending on where in the state you live you will likely also pay local income taxes. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Use our free income tax calculator to work out how much tax you should be paying in Australia.

That means that your net pay will be 45925 per year or 3827 per month. If your employer pays you by the hour multiply your hourly wage by the number of hours your work each week. Using the annual income formula the calculation would be.

Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. It can also be used to help fill steps 3 and 4 of a W-4 form. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Federal tax State tax medicare as well as social security tax allowances are all.

Calculate Income Tax On Salary Hotsell 55 Off Www Ingeniovirtual Com

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Formula Excel University

How To Calculate Foreigner S Income Tax In China China Admissions

Paycheck Calculator Take Home Pay Calculator

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

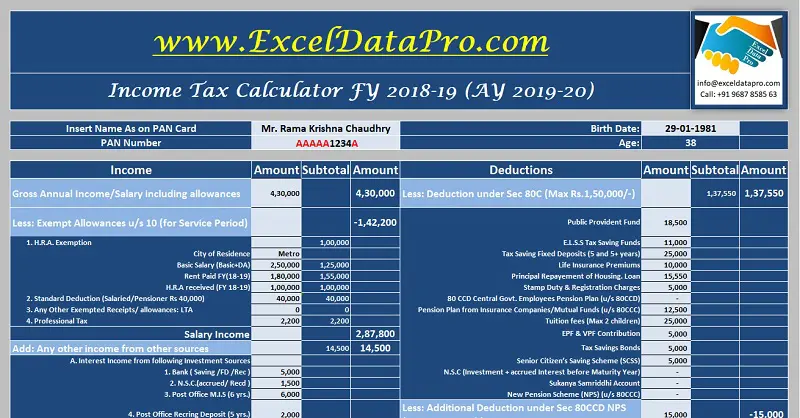

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Paycheck Calculator Take Home Pay Calculator

Income Tax Formula Excel University